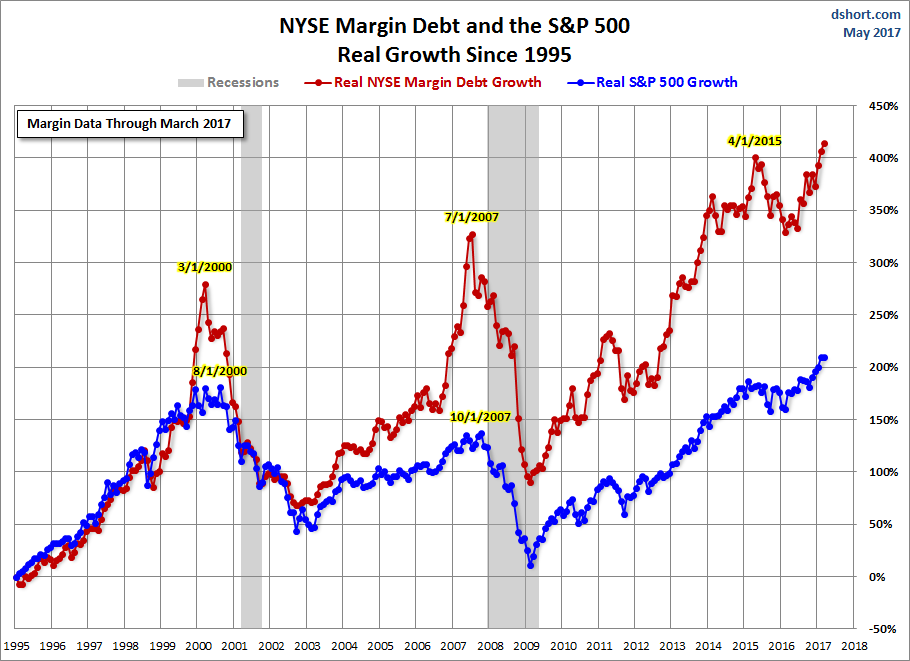

Trumptonium wrote:Quite true. But a major difference between now and 1925-1929 is the difference in the behaviour of banks. There's no margin lending today.

Trumptonium wrote:[img]https://infographic.statista.com/normal/chartoftheday_8925_tesla_vs_gm_and_ford_n.jpg

I'd rather show Apple as an example. 1000% growth within 8-9 years is not the prime example of sustainability tbf.